By Jay Carter, Founder and CEO, MarketView

M&A activity is at an all-time high. The number of transactions is high, valuations are high. Some business owners are approached on a daily basis by eager buyers, hoping their timing is right and the owner is willing to sell their business. With all of this activity comes a lot of confusion-especially for the business owners.

Business owners are business owners. They build and operate businesses. They do not typically buy and sell businesses. So, even though M&A activity is at an all-time high, it’s actually not for most business owners. Most have still never bought or sold a business and when approached by potential buyers, they are, understandably, uncertain about what to do.

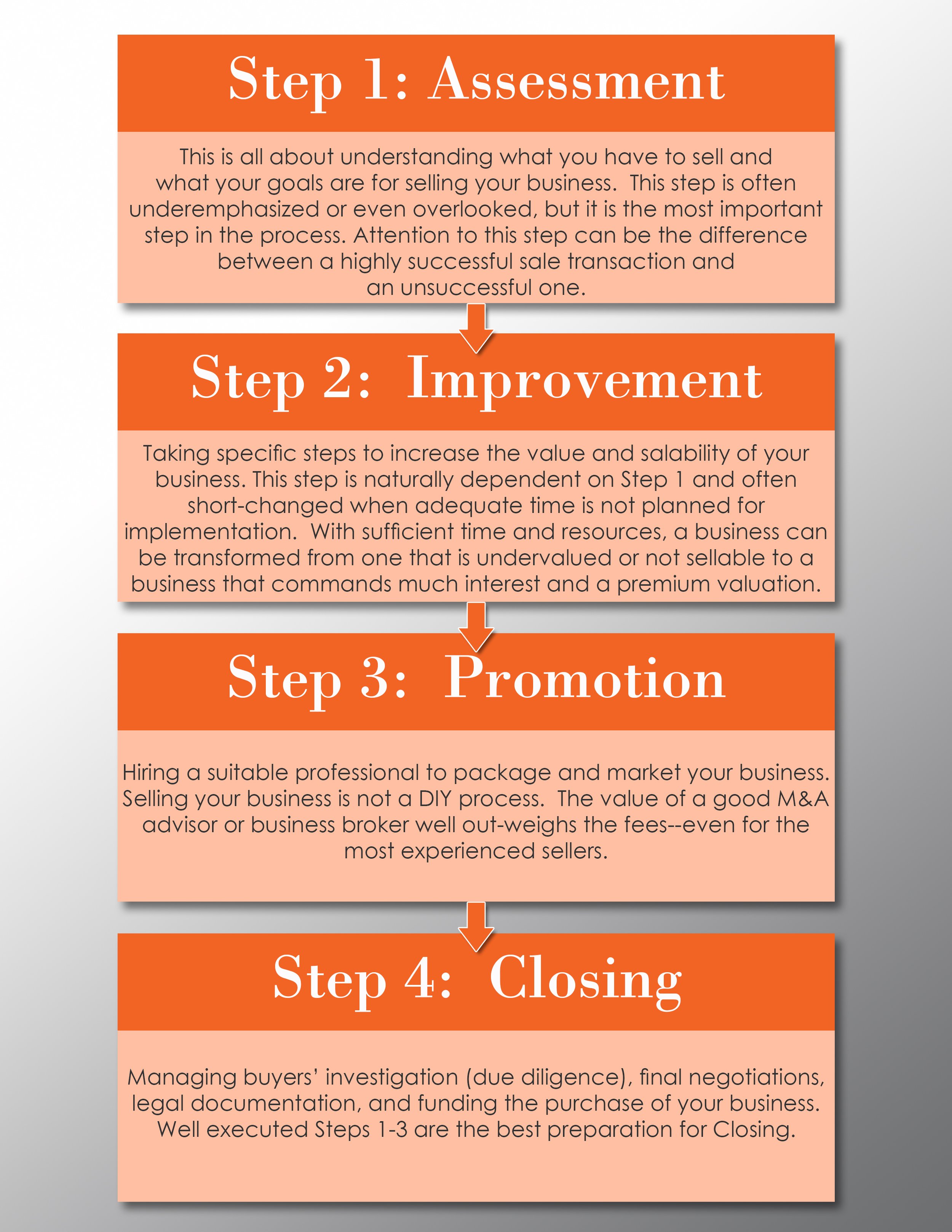

In this article, I am identifying the four steps to selling a business and discussing Step 1 in detail. (Steps 2-4 will be the topics of my next three posts.). Understanding the four steps is a great place to start for anyone thinking of selling their business at any time in the future.

Let’s identify the four steps to selling a business.

Today, we’re focusing on Step 1 in the sale of a business. This is the first of our four part series discussing the four steps in selling a business.

This step can begin at any time (and repeated as needed), and the sooner you take it, the bigger the payoff. Step 1 begins by taking a deep dive look at the business from the perspective of a buyer and understand exactly how a buyer will value your business, how they will compare your business to other businesses, what could make your business less valuable to a buyer, and what could make it more valuable to a buyer.

It’s about objectively evaluating your business from the inside, and also getting inside the heads of potential buyers, and understanding how they will view your business. What is it that makes your business valuable to buyers? And, from this perspective, what can you do to your business before putting it on the market to make it more valuable and more salable to potential buyers?

The second component of Step 1 is to determine your goals as an owner of the business. While easier said than done, it is crucial that you have concrete goals for exiting the business. Without concrete goals in Step 1, rational decisions that must be made during Steps 2, 3, and 4 are illusive. As the owner, Step 1 should include specific financial and non-financial goals that you hope to achieve through a future sale of the business. It should also begin to paint a picture of what your life will look like after your business is sold.

If selling your business at any time in the future is a possibility, you have begun Step 1. Use the Selling a Business-Step 1 Checklist at the end of this document to determine your progress and prepare for Step 2.

Is Step 1 something you can tackle yourself, or give to your CFO to do? Of course you can, but I wouldn’t recommend it. Most business owners have access to the internal company information necessary to complete Step 1. And with some digging, you could probably locate and purchase the data necessary to evaluate the business and determine a valuation range. But I wouldn’t recommend doing this work internally for a lot of reasons. Here are three big ones:

Step 1 is extremely time-consuming, especially if it is not something you do every day. Attempting Step 1 without outside help takes the time and attention of the owner and staff away from the company’s core business, and the business suffers as a result.

Step 1 is most valuable when completed with objectivity. Owners and staff are not objective and just can’t offer the impartiality needed to see the business without prejudice.

If you are like the majority of business owners, you just won’t find time to do it. Even with the best intentions, most business owners never get around to doing this work and unless they hire someone to do it for them, they completely lose out on the value it creates.

So what should you do? Step 1 is a lot like visiting a radiologist. You want to have a clear picture of the state of your business today compared to what is considered normal or healthy, and if there is anything that appears problematic, you want to know about it as soon as possible. You want to understand the potential consequences of any issues, and you want to understand your options for dealing with them.

Hire a professional exit advisor to complete Step 1 for you. This is the best way to launch a sale process. A professional exit advisor should be able to complete all of the work required for Step 1 and deliver a full report and plan in a timely manner (about 30 days). This is well worth the investment (advisors typically charge between $10,000 and $30,000, depending on complexity). The greatest benefit to hiring a professional for the Assessment phase is that you begin the sale process with a sturdy foundation from which to launch the next three steps of the sale process.

In the next issue, I’ll be covering Step 2 of the four-step sale process: Improvement

See Selling a Business-Step 1 Checklist on the next page. This is not an all-inclusive checklist by any means but it is very helpful for identifying some key areas of the business that deserve attention before moving forward with a sale process.

For more information about the four steps of a business sale, please feel free to contact me.

Jay Carter

Founder and CEO

MarketView

704-904-7543

jcarter@market-view.com